Set up and apply full or partial scholarships to specific children to reduce (or eliminate) the amount owed for tuition.

Before You Begin

If you are receiving money to use for scholarships, there are several possible methods for recording this revenue. See: Donations, Grants, Fundraisers & Scholarships

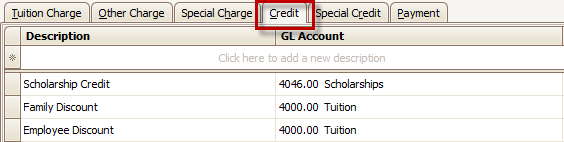

Set Up a Scholarship Credit

Create a Credit Description, called something like “Scholarship Credit”, within your Charge / Credit Descriptions. This could be counted as a credit against regular tuition revenue (like GL Account number 4000.00 Tuition) or you could add a new revenue account (to your Chart of Accounts) specifically for scholarships.

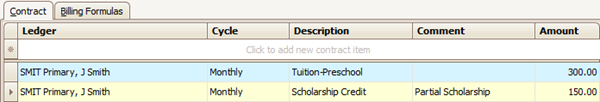

Assign Scholarship to a Child

The key to applying the scholarship is to use the Child’s Billing Box. Set up the Billing Box with the regular Tuition Charge on one line and the Scholarship Credit on another. If the amounts are the same (full scholarship) the family will end up with a zero balance; with a partial scholarship the family will end up owing a reduced amount.

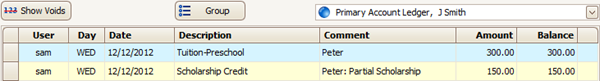

Once you run Automated Billing, two lines will appear on the Family Ledger Card (and on Customer Statements) making it clear to the Payer (parent) that they are receiving a scholarship.

Note: Using two lines (full charge less a scholarship credit) is preferable to just charging a reduced rate to begin with (on a single line), both because the parent will see the benefit of the credit and your financial reports will show how much you’ve given out in scholarships.