- 13 May 2024

- 3 Minutes to read

- Print

Tuition Express Guide

- Updated on 13 May 2024

- 3 Minutes to read

- Print

This article includes information about Tuition Express including rates, payout timelines and how to reconcile your payments.

FAQs:

Q1. I received a deposit at my bank that I can’t find on Procare Online.

Check your failed payments, do you have a failed payment you need to take into account? It is possible your bank grouped the deposits you received with the failed payment and you are seeing the total that was deposited? (likely lower than expected).

Q2. A parent was on auto pay but their payment was never drafted.

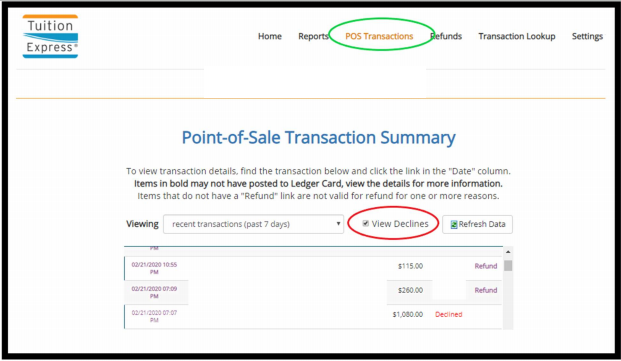

That is most likely due to a failed credit card payment. To see that information, you will need to log onto Tuition Express. Go to POS Transactions (circled in green) and enable View Declines (circled in red):

Q3. Why do I see withdrawals? Why is Tuition Express taking money out of my account?

To get faster payment timings, Tuition Express deposits funds before the ACH payment clears (three business day settlement process). If the payment ultimately fails and has a Return, those funds will be withdrawn and you will be notified via email detailing the Return. The withdrawal could possibly be your transaction fees, those are withdrawn once a month on the 1st . See your Merchant Statement for details.

Q4. What are the transaction funding timings?

Funds are typically processed the following business day subject to bank funding and processing approvals.

- ACH if run before 4pm ET

- Credit card if run before 7pm local time (center’s time zone)

- If it is run after those cut offs it will be deposited in two business days

Q5. I received my payment, why is it still showing as “Processing”?

Tuition Express funds are typically processed the following business day subject to bank funding and processing approvals (based on funding timings outlined above). If the payment does not clear it will ultimately be withdrawn from the account. During this settlement time, it will display as “Processing”. When the payment has cleared it will show “Success” in Procare Online. This can take up to 4 business days.

Q6. Can I process online payment refunds in Procare Online?

ACH refunds can be processed in Procare Online.

Q7: We pulled some manual payments from parents in error, can we cancel those payments before they finish processing?

There is not a way to cancel an individual payment but we are able to cancel the batch. Please note that this will cancel all ACH payments for that day. This can also cause automation and status update issues. If you would still like to proceed or have more questions, please reach out to Procare Support directly to go over details.

Q8. “Notification of Change” We got an email from Tuition Express that an account number was wrong but the funds were deposited and there was a fee.

This is called a NOC (Notice of Change). That means there was a small error made by the parent (account number may have been just 1 number off, old routing number, etc.) but the bank decided to honor that payment one time. The parents will need to go in and correct their payment information. This service incurs a fee.

Pulling Online Payment Reports

- The Bank Account Activity report will give an overview of the deposits sent to your bank.

- TE OL – is ACH transactions

- TE POS – is credit card transactions

- To see the payment breakdown details for each deposit, pull the:

- Transaction Batch Details – ACH Payments

- Payout Expected Deposit – Credit Card Payments

Important: Keep in mind any payments received after the second to last business day of the cycle after the batch close time will show on the next cycle’s report (4 pm ET for ACH, 7 pm center’s time zone for Credit Card). To see payment timings, go to Billing > All transactions and filter by date and transaction type “Payment”.

- The date the deposits are sent to your bank may not be the day the bank puts those funds into your account. Bank deposit timings can vary.

- If you feel you have a payment “missing” or “lower than expected” check to see if that deposit total included a with drawl from a failed payment (section below).

Failed Payments & Transaction Fee Reports:

There are a few other reports you may need to use if you have reconciliation questions.

- ACH Returns/Credit Card Declines: this report is a good resource for looking up why an ACH payment failed.

- Merchant Statement: This report will outline the transaction fee charges from Tuition Express to your school each month (typically at the beginning of the month).