Early in 2025, you will have access your 2025 Tax Tables and 2024 W-2/1099 forms. Access them for free if you are on a monthly subscription for Procare or have an active annual maintenance plan.

Effective immediately, the annual maintenance package for Procare Desktop customers on a non-hosted (local) version of Procare will no longer be available. 2026 Tax Tables and 2025 W2/1099 forms will also not be made available. Customers must move to a hosted (Cloud) version of Procare to continue accessing these items.

Customers who purchased a 2025 annual maintenance plan will continue to receive product updates and support through December 31, 2025.

Tax Tables for the New Year

View the Tax Tables for the New Year article if you've previously downloaded tax tables and now need updated tax formulas for the new year. Payroll tax tables include formulas for federal income tax, FICA – Social Security, FICA – Medicare, and state income tax tables.

W-2 Software

Learn how to download and and use the optional W-2 software compatible with Procare’s Payroll module. Learn More

Additional Information

Let Procare guide you through end-of-year tax preparation and setup with helpful articles, FAQs and videos. See: Be Ready for Tax Season

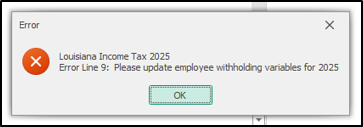

Iowa and Louisiana have transitioned from a tiered tax system to a flat rate based on filing status. To ensure accurate employee withholding, these changes require updating the employee withholding box.

Instructions for updating can be found here: Employee Withholding Update. Failure to update these values will result in the below error message, indicating that the withholding box needs updating.