Tax season can feel overwhelming, but Procare makes it easier by providing the tools and resources you need to prepare W2s, 1099s, and other essential reports. Below you’ll find guidance on the most common year‑end questions.

Tax Essentials

Review information and guidance on common tax questions and scenarios

W2s and Tax Forms

Tax Tables

Vendor Tracking

How do I set up Vendor Tracking for 1099s?

Beginning Balances

More Tax Resources

End of Year Reconciliation

Financial reconciliation ensures your records are accurate and aligned. As we close out the year, here are key resources and tasks to help you stay on track:

Getting Started

If you are new to reconciliation, you may like to review our Reconcile First Time article.

Common Scenarios

For Bank Statement Reconciliation

If you have a digital payment that was successfully processed but did not post to the ledger, follow these steps

Recommended Year-End Tasks

Reconciliation Reminder

If you’re having trouble reconciling your ledgers, it may be due to recent technical issues we communicated to impacted customers. While most have been resolved, some centers may still see errors if ledger entries weren’t corrected during the year.

We recommend reviewing communications and data shared with you and reviewing the article An Important Update Regarding Procare Desktop Ledgers.

If you require assistance or clarification, please reach out to our support team:

Customer Support Hours

Monday–Friday: 7 AM – 8 PM ET

Phone: (800) 964-1729

FAQ

Can I show a housing allowance on W2s?

Yes. You may wish the housing allowance to appear in a specific box on the W2, for example, the box for “other”. If you are using Procare W2 / 1099 Software, you can manually edit W2s for that person as needed. Contact your tax adviser or the IRS to determine how the information should be reported.

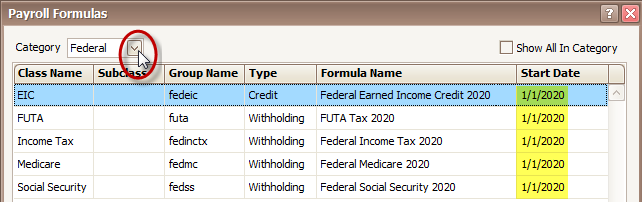

How can I tell if I have the most current tax tables?

From the Procare Home screen, go to Configuration > System > Accounting Management > Payroll > dbl-click Payroll Formulas. At the Payroll Formulas screen, choose either the Federal or State category (top left). On the right-hand side of the screen you’ll see a Start Date which indicates the effective date. In most cases this will be January of the current year. Mid-year changes will show a date after January 1st.

How do I order Tax Tables for the New Year?

The annual maintenance package for Procare Desktop customers on a non-hosted (local) version of Procare will no longer be available. 2026 Tax Tables and 2025 W2/1099 forms will also not be made available. Customers must move to a hosted (Cloud) version of Procare to continue accessing these items.

Customers who purchased a 2025 annual maintenance plan will continue to receive product updates and support through December 31, 2025.

Important Message for Desktop Local Customers

Effective immediately, the annual maintenance package for Procare Desktop customers on a non-hosted (local) version of Procare will no longer be available. 2026 Tax Tables and 2025 W2/1099 forms will also not be made available. Customers must move to a hosted (Cloud) version of Procare to continue accessing these items.

Customers who purchased a 2025 annual maintenance plan will continue to receive product updates and support through December 31, 2025.