Refunds can be issued for payments made by check, cash, credit card, or bank account. You can issue full or partial refunds and easily track them in the system.

Processing Card and ACH Refunds (Full Amount)

Need to refund a payment? You are in the right place. You can issue and keep track of refunds easily by following the steps below.

Important: Once a refund is initiated, the Refund Status will show as In Process, visible to both parents and the center.

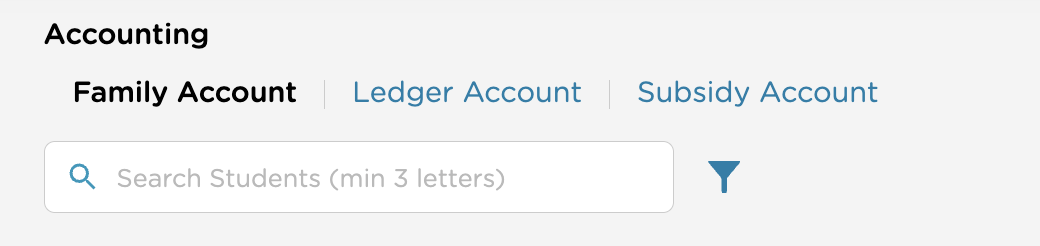

Go to Billing > Accounting > Family Account.

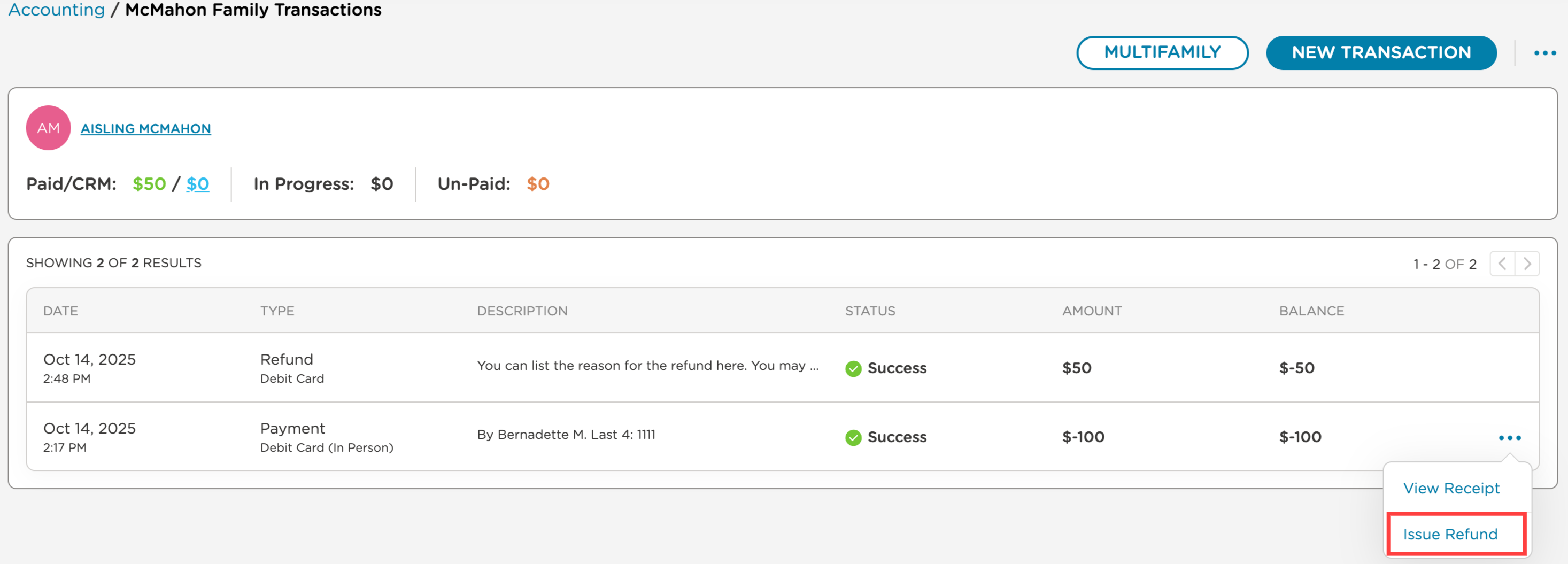

Locate the payment to refund in the transaction list.

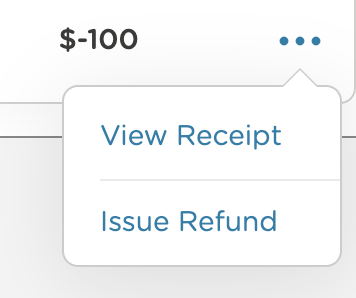

Click More Actions > Issue Refund.

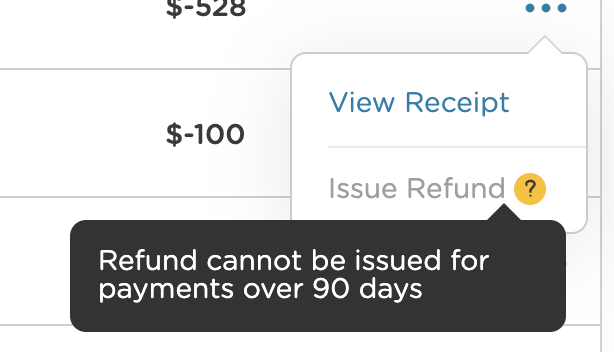

If the button is grayed out, the payment isn’t eligible for a refund. The reason will be displayed.

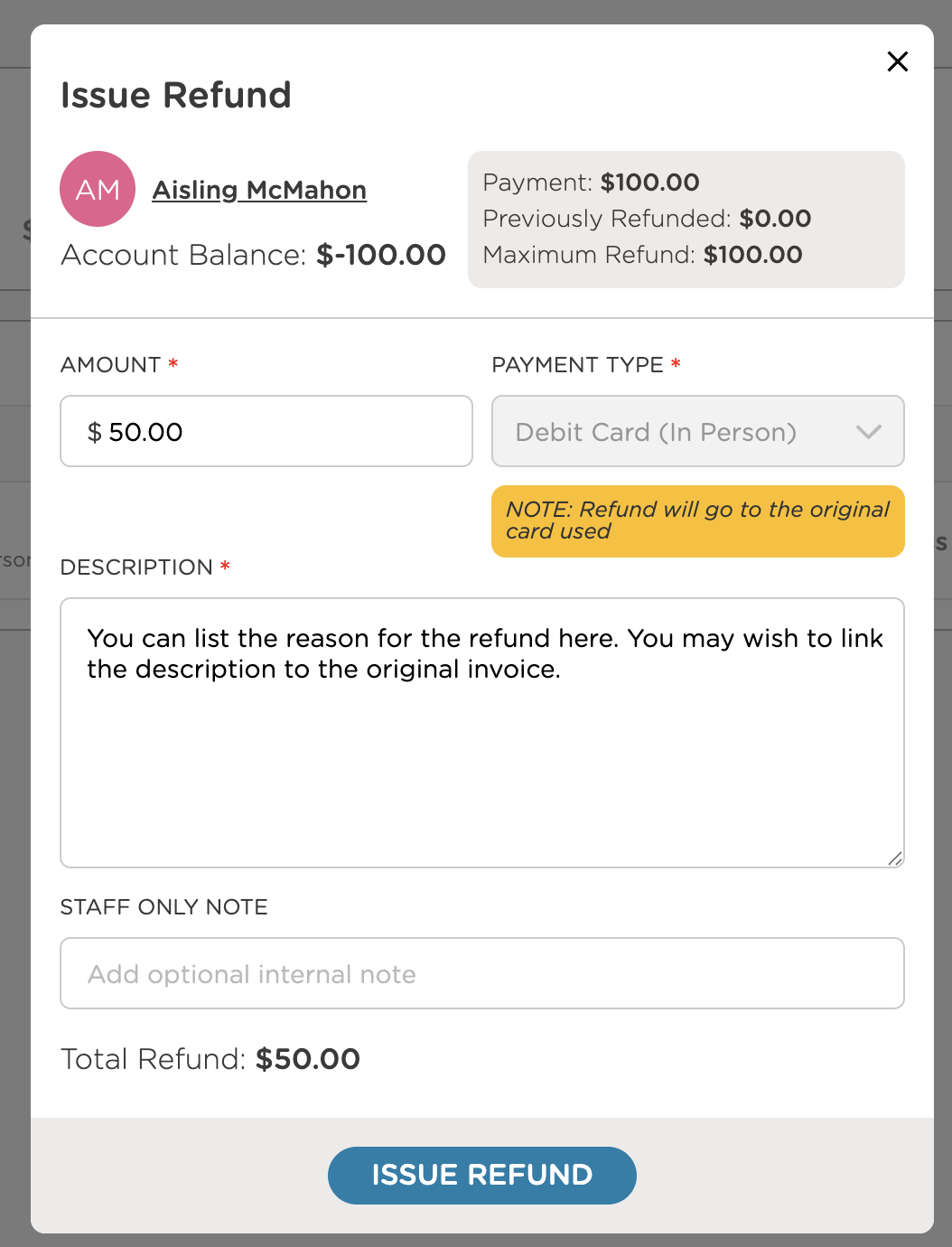

Complete the Issue Refund pop-up:

Amount: Defaults to the full payment amount. Adjust to issue a partial refund.

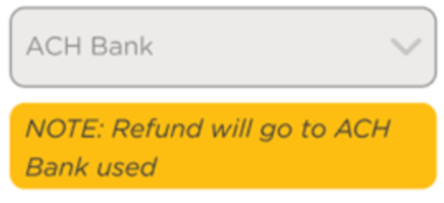

Payment Type: This is automatically selected for card or ACH payments. For other payments, choose Cash, Check, or Other.

Description: Shown in the transaction list and on the family statement.

Staff Only Note (optional): Internal note visible only to staff. Click the yellow paper icon to view.

Click Issue Refund.

Online payments will automatically be refunded to the original credit/debit card.

Processing Partial Card and ACH Refunds (Partial Amount)

Partial refunds allow you to return a portion of a payment while keeping records accurate. You can issue multiple refunds for a single payment, as long as the total refunded amount does not exceed the original payment.

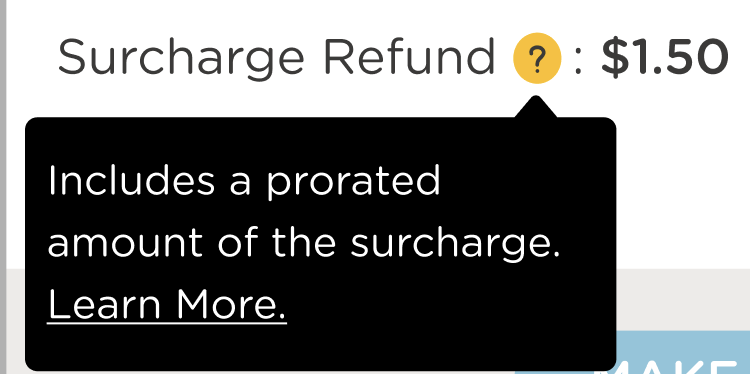

Surcharge Refund

If a surcharge was added to the original payment, the total refund includes the amount entered in Issue Refund > Amount plus the prorated surcharge. This total will be shown as the Total Refund.

For Billing Admins

Follow the steps below to issue a partial refund:

Navigate to Billing > Accounting > Family Account

If it is a multi-family account, select the parent whose payment you want to refund. This will show the parents’ transactions.

Locate the payment in the list of transactions.

Click More Actions, then select Issue Refund.

If the Issue Refund option is grayed out, the payment isn’t eligible for a refund. The reason will display on-screen.

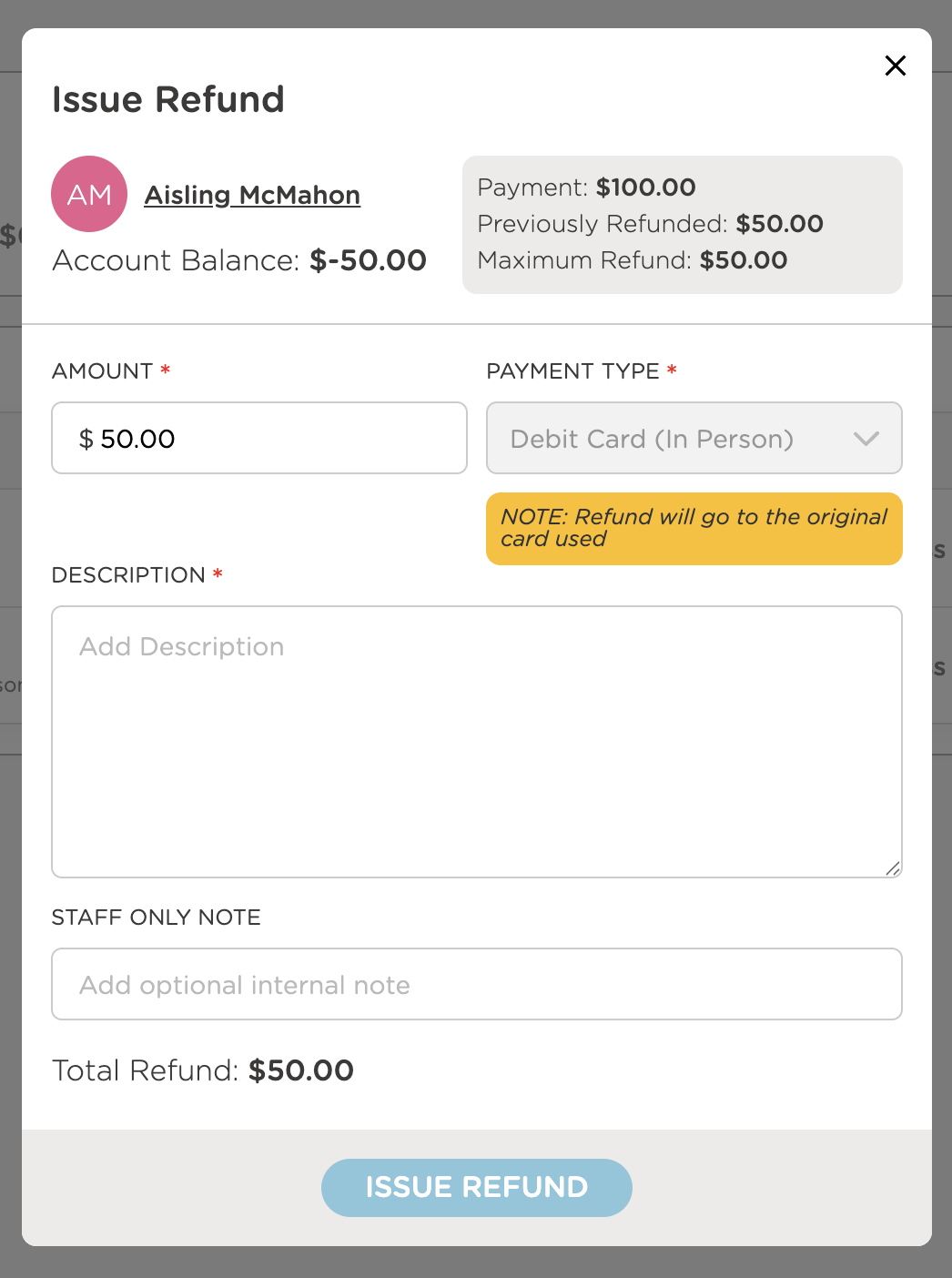

In the Issue Refund window, review the original payment amount and any previous refunds.

For example, if the original payment was $35.00 and $25.00 has already been refunded, the system will show a maximum refundable amount of $10.00.

If a pending refund exists, it is automatically included in the available refund amount.

For example, if a $35.00 payment has a $30.00 refund pending, only $5.00 remains available to refund.

Enter the refund amount you want to issue.

If you enter an amount higher than the remaining refundable balance, the system will automatically adjust it.

Surcharge Refund

If a surcharge was applied to the original payment, the Total Refund includes the amount entered for the refund plus the prorated surcharge.

The refund will automatically return to the original payment method.

Enter a description. This will appear on the transaction list and on the family statement.

(Optional) Add a Staff Only Note for internal use.

Select Issue Refund to complete the transaction.

Once processed, the refund will appear in the family account transaction history, and the remaining refundable balance will update automatically.

How Families Can See Transactions

Families can see all payments and refunds, including refund descriptions, in the parent portal under Payments.

Processing Cash or Check Refunds

To refund a cash, check, or other payment, follow the standard refund steps and select Cash, Check, or Other as the payment type.

Partial Refunds FAQ

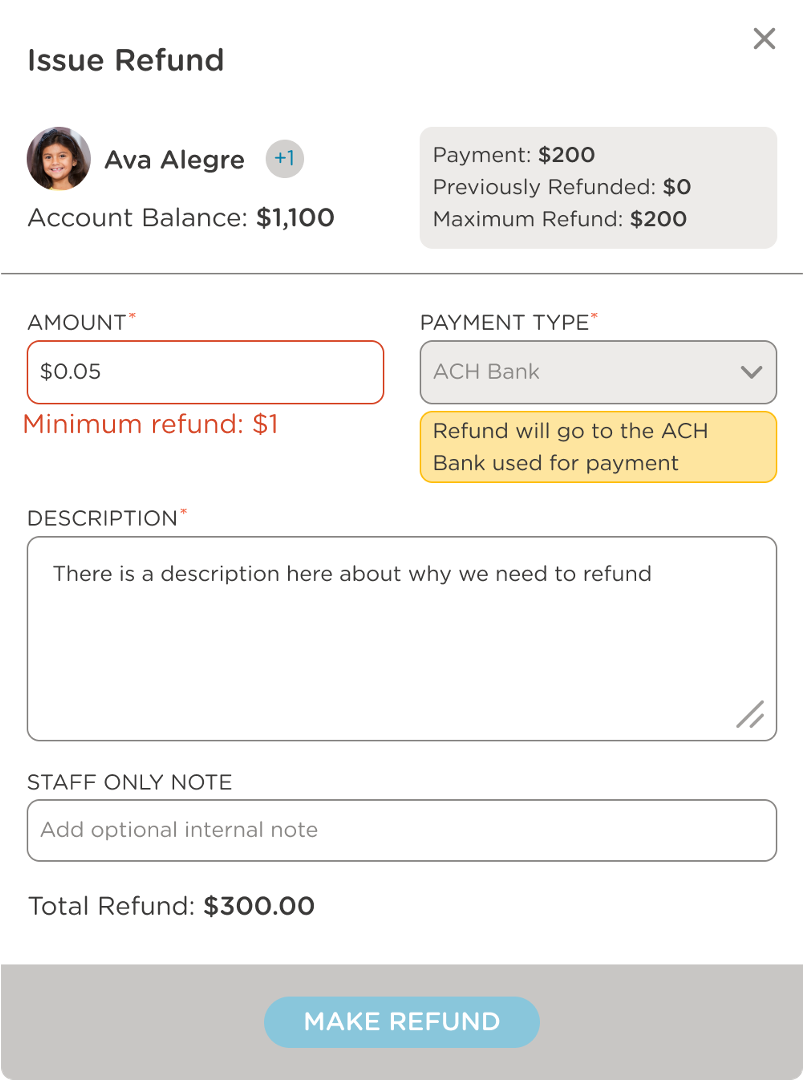

Is there a minimum amount I can refund?

Yes. The minimum refund amount is $1.00. Refunds smaller than $1 can’t be processed.

What happens if I try to refund more than what’s available?

The system automatically adjusts the refund to the maximum refundable amount, preventing over-refunds and keeping records accurate.

Can I issue multiple partial refunds for the same payment?

Yes. You can issue multiple refunds as long as the total refunded amount does not exceed the original payment. Each refund will appear as a separate transaction in the child’s account.

In this example, the payment was $100, and $50 had previously been refunded, leaving a maximum partial refund amount of $50.00.

If the original payment included a surcharge, will it also be refunded?

Yes. Any surcharge is refunded at a prorated rate. The prorated amount is automatically calculated and displayed on the refund screen before you finalize the transaction.

Are there any limits on when I can issue a refund?

Yes. ACH and card refunds must be issued within the allowed transaction timeframe. Refunds made after this window must be handled outside the system.

What if a pending refund already exists for the same payment?

Pending refunds are automatically factored into the remaining refundable balance. For example, if a $35 payment has a $30 refund pending, only $5 will remain available to refund.

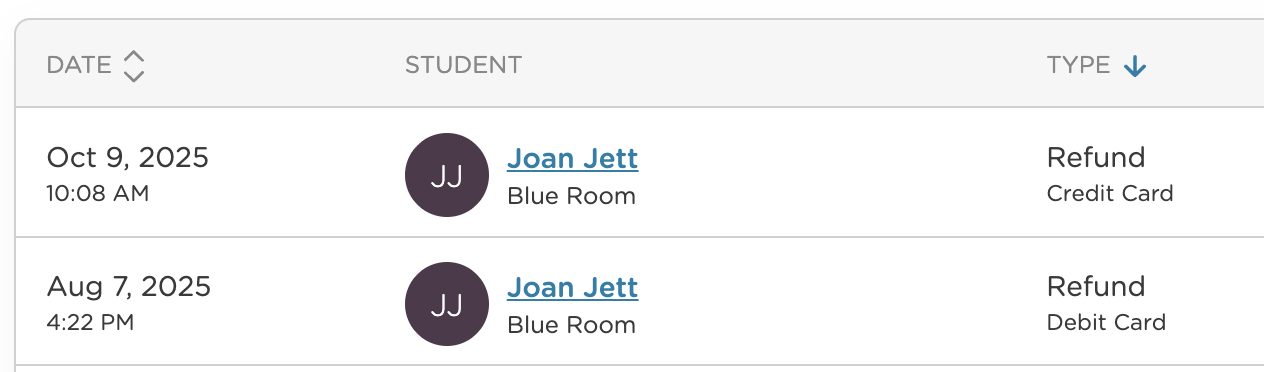

How do I see the refunds I’ve issued?

You can view refunds in several ways:

Billing > All Transactions: Sort by type and select “Refund” to see all refunds.

Billing>Family Accounting: Refunds appear in the transaction list.

Billing Reports: Refunds also appear in your billing reports.